画像をダウンロード 670 credit score interest rate 818919-670 credit score mortgage interest rate

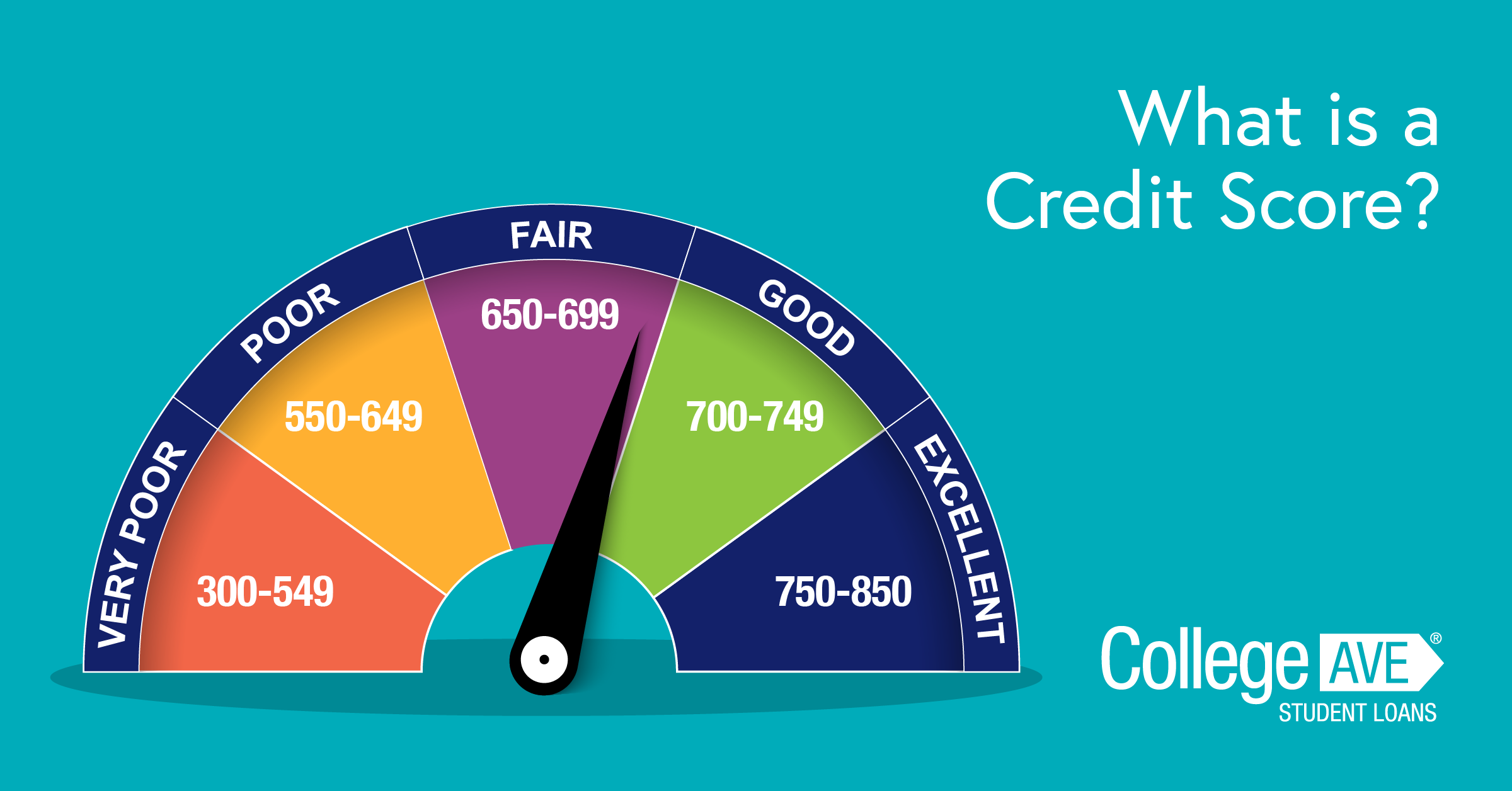

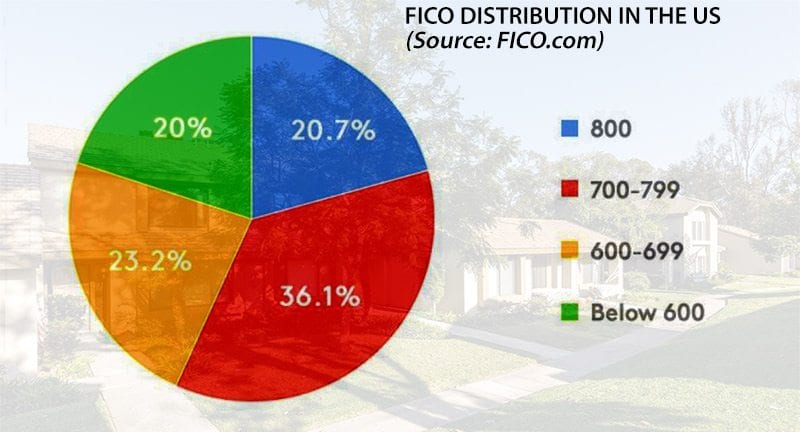

Most of the low interest credit cards offer an introductory rate of 0% for 6 to 18 months and then that APR rate will rise to a set amount above prime From a genuine financial standpoint, if you can find a credit card with no annual fees and super low APR rates for a credit score between 670 and 679, jump on it!Mar 26, 21 · The average mortgage interest rate is 298% for a 30year fixed mortgage, influenced by the overall economy, your credit score, and loan typeThe scores range from 375 to 900 points, and in general, a score of 650 or above indicates a very good credit history Average FICO scores fall into the range between 6 and 650 It must however be noted that not all lenders give same value to a particular credit score

Credit Score Hiep S Finance

670 credit score mortgage interest rate

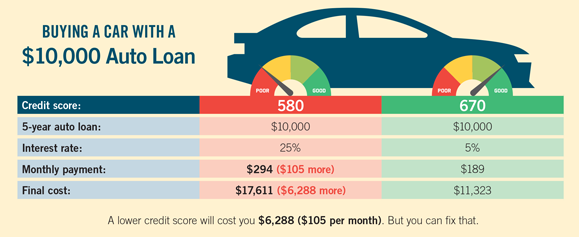

670 credit score mortgage interest rate-It's important to remember that everyone's financial and credit situation is different, and there's no "magic number" that may guarantee better loan rates and terms Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair;May 15, 17 · A target credit score of 660 or above should get you a car loan with an interest rate around 6% or below That data comes from a June report from credit bureau Experian It also found that

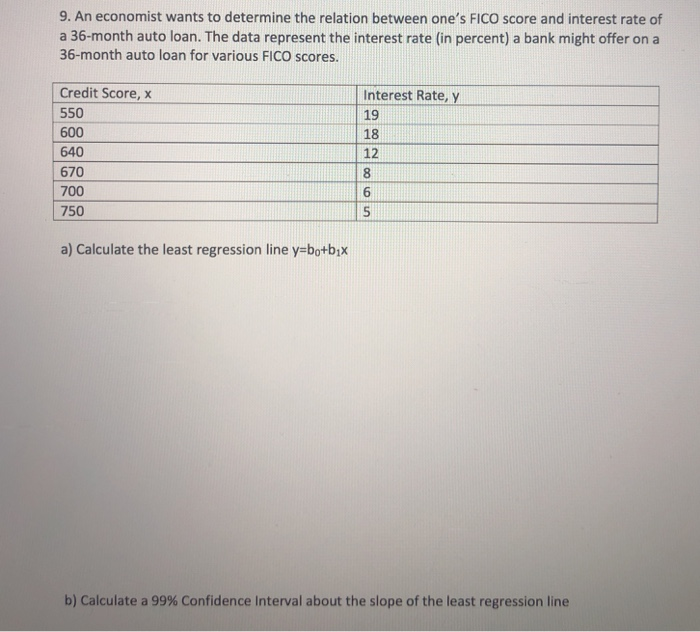

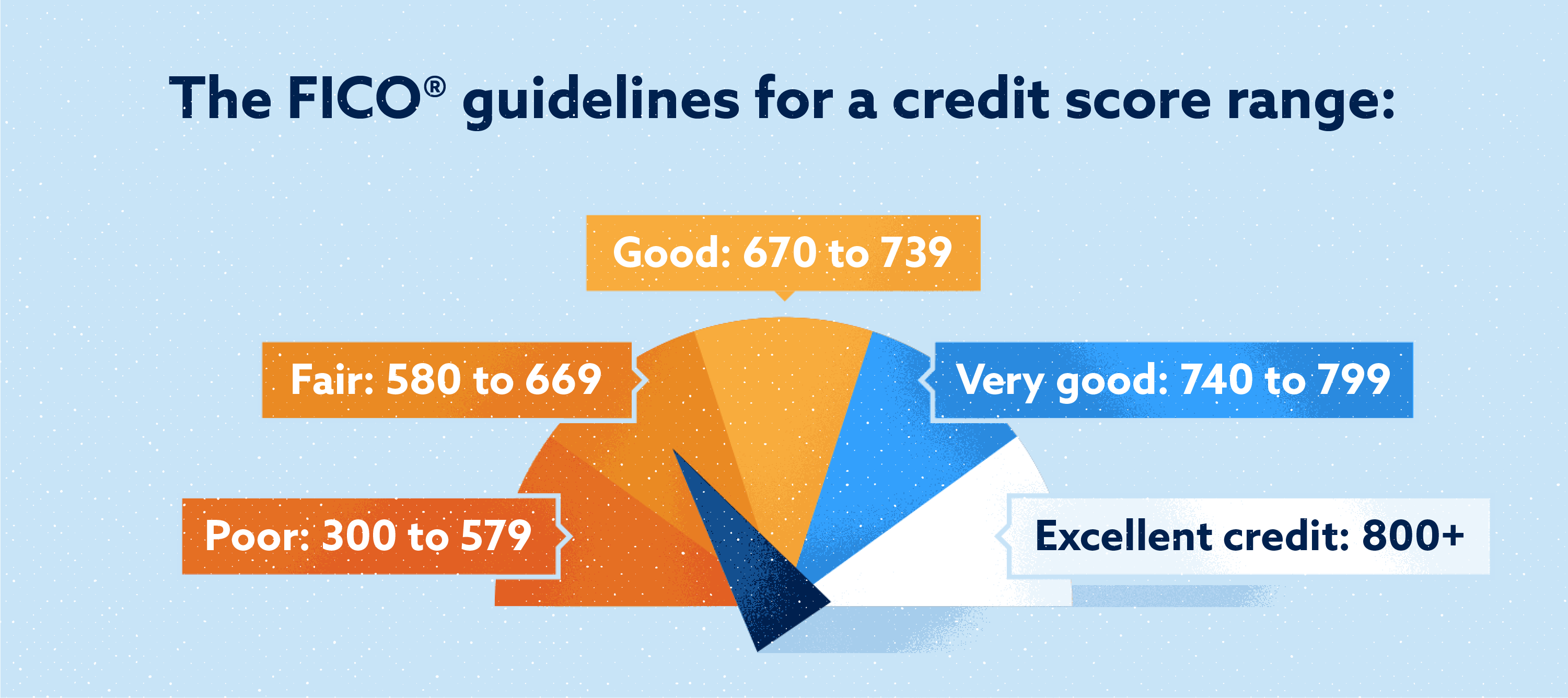

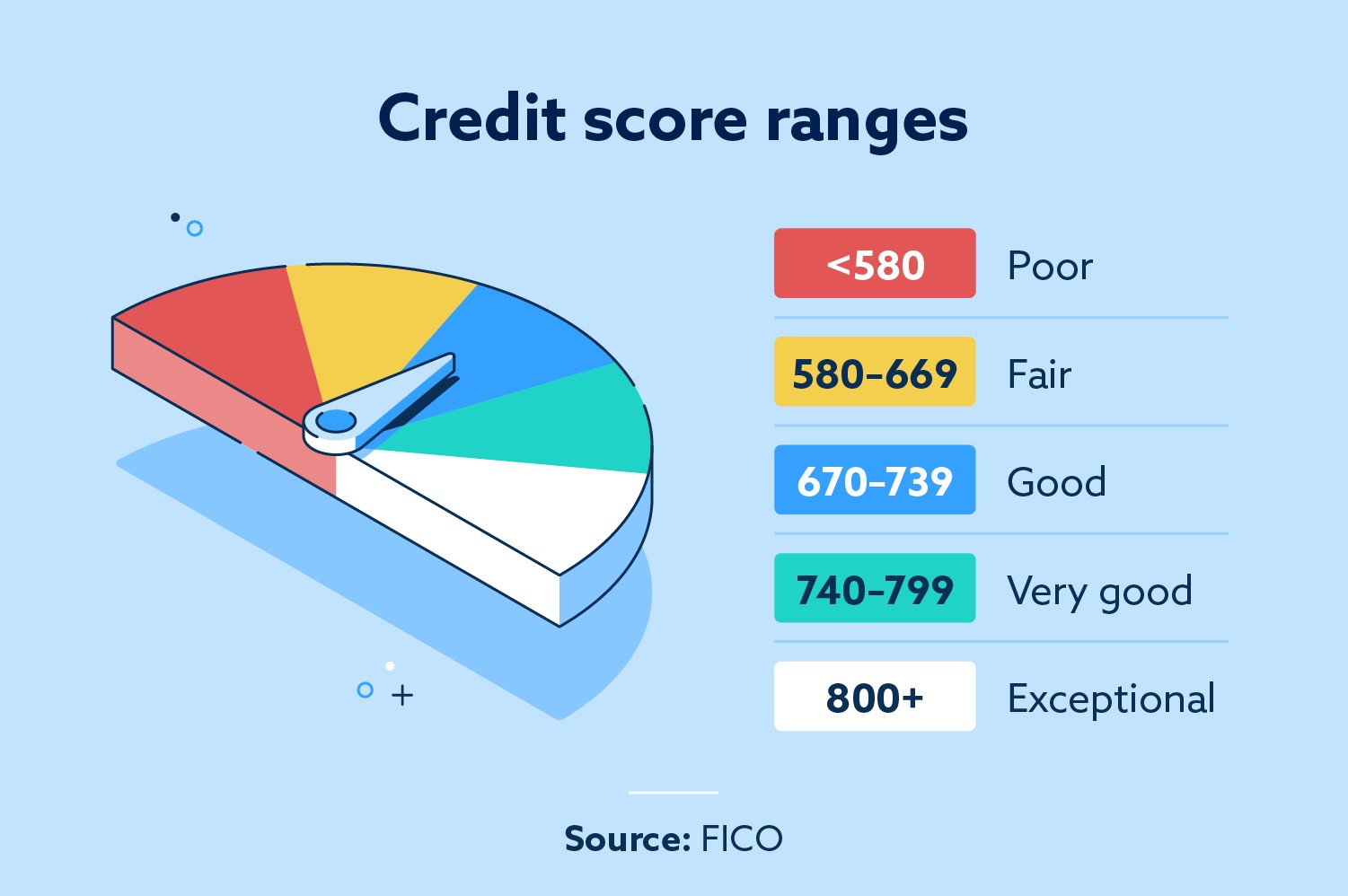

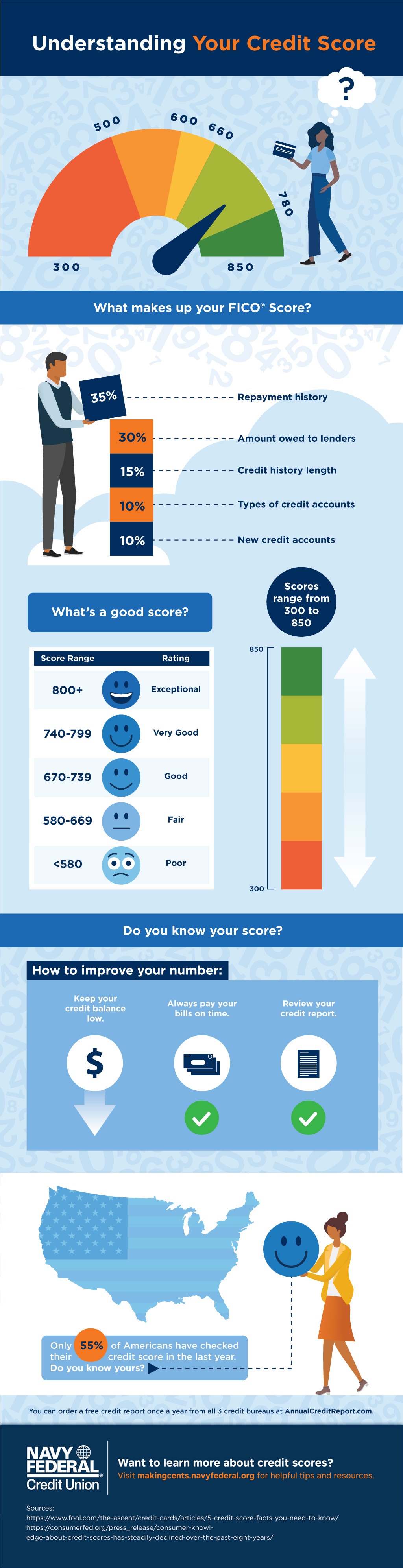

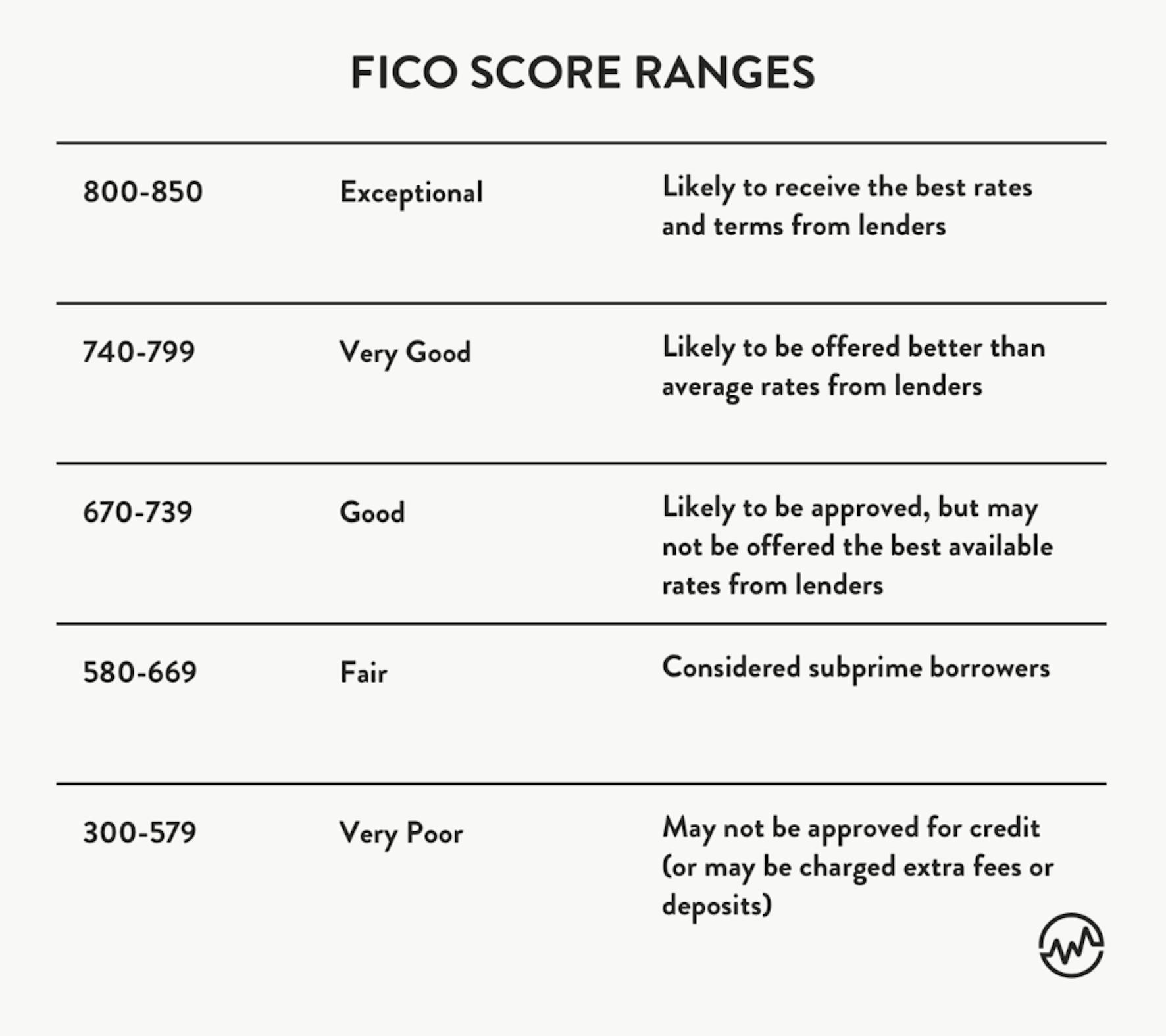

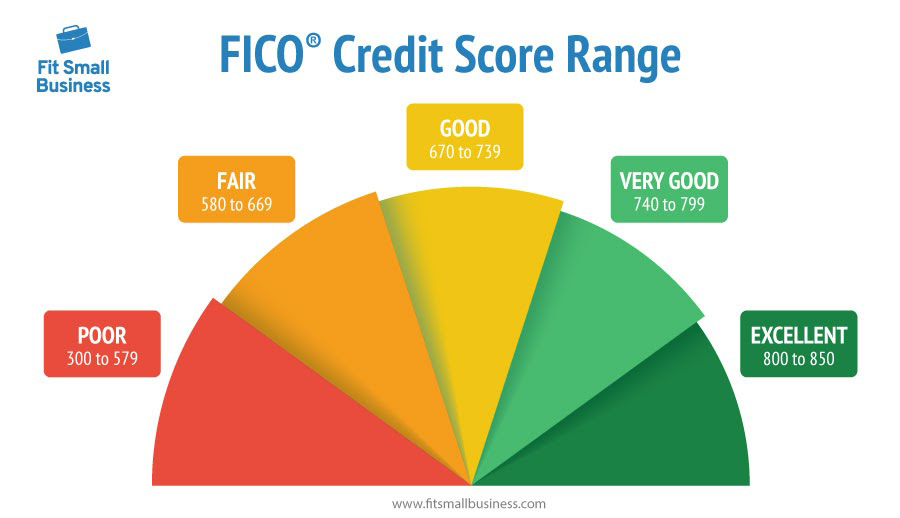

May 06, 12 · The FICO credit scoring model is the most commonly used by lenders The score is used to determine whether or not to extend credit, and also at what interest rate A 670 FICO score is accepted as a "real" score by lenders who will allow the individual to qualify for the credit, but not at the best interest rates FICO Credit Score RatingsJan 25, · For instance, if your credit score is 658 and you qualified for a loan with 365% interest,Aug 08, 19 · Here are the ranges for Equifax credit scores Poor Below 559 points Fair 560 to 659 points Good 660 to 724 points Very good 725 to 759 points Excellent 760 to 850 points The highest Equifax score that you can have is 850 points A 670 credit score puts you squarely in the "good" range

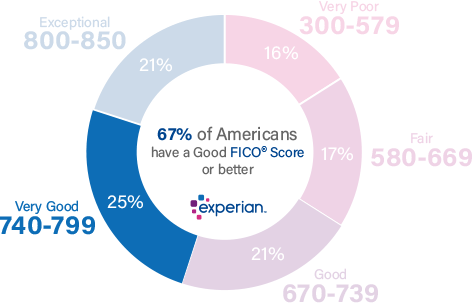

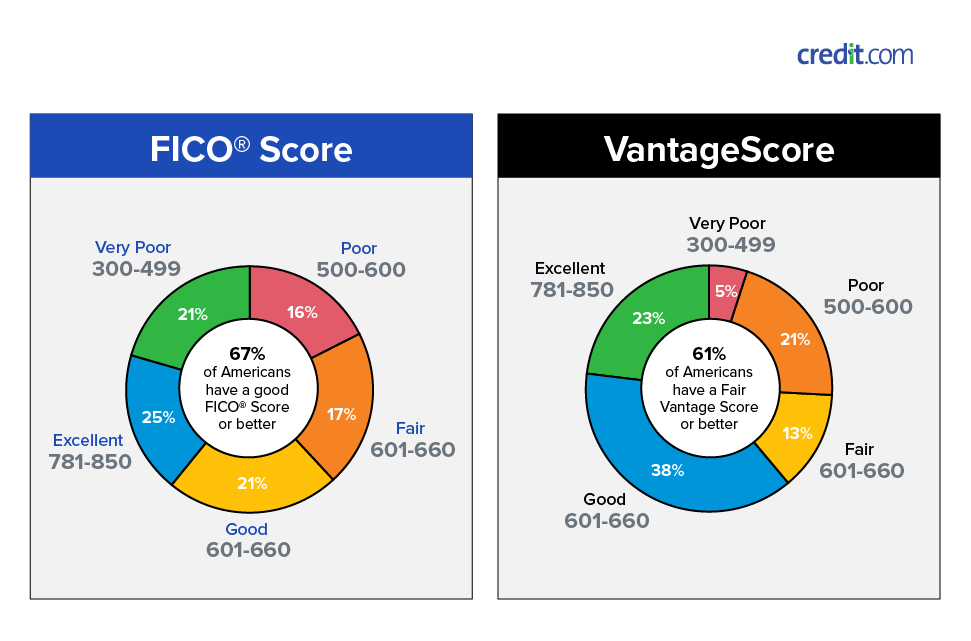

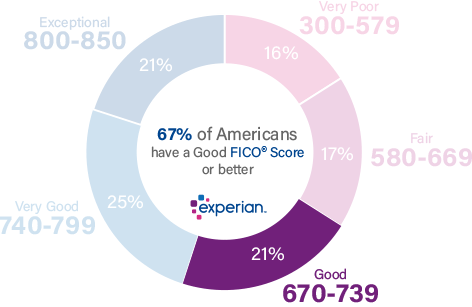

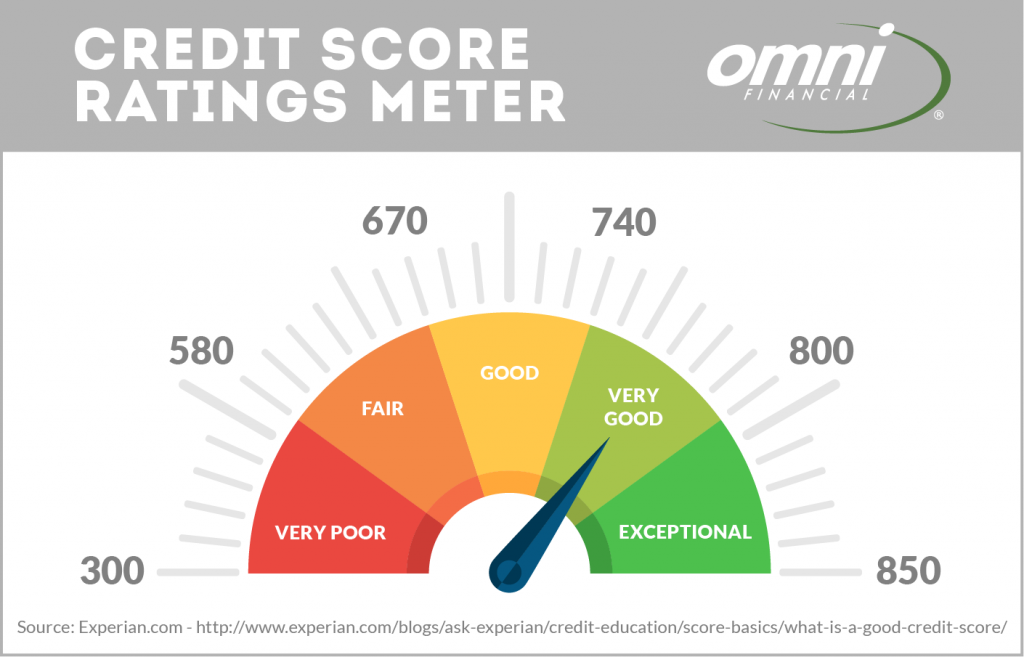

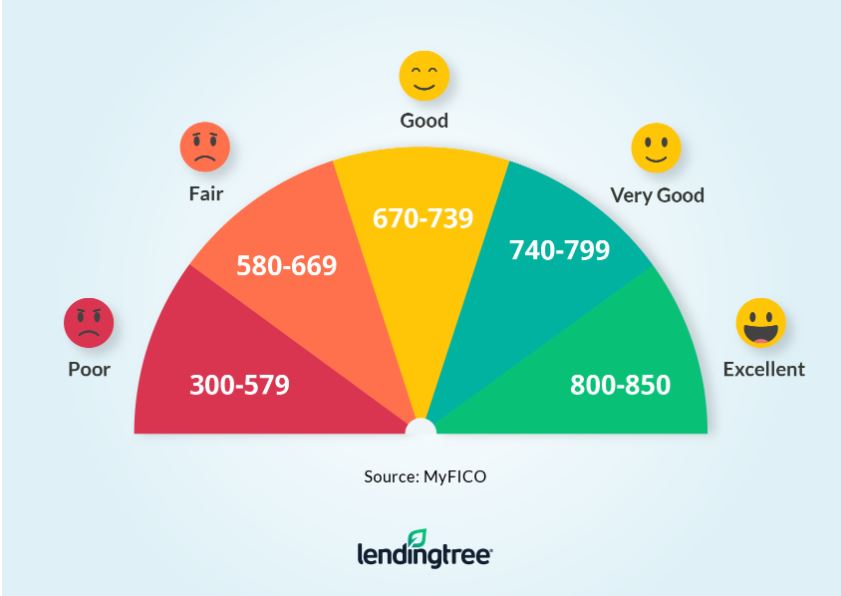

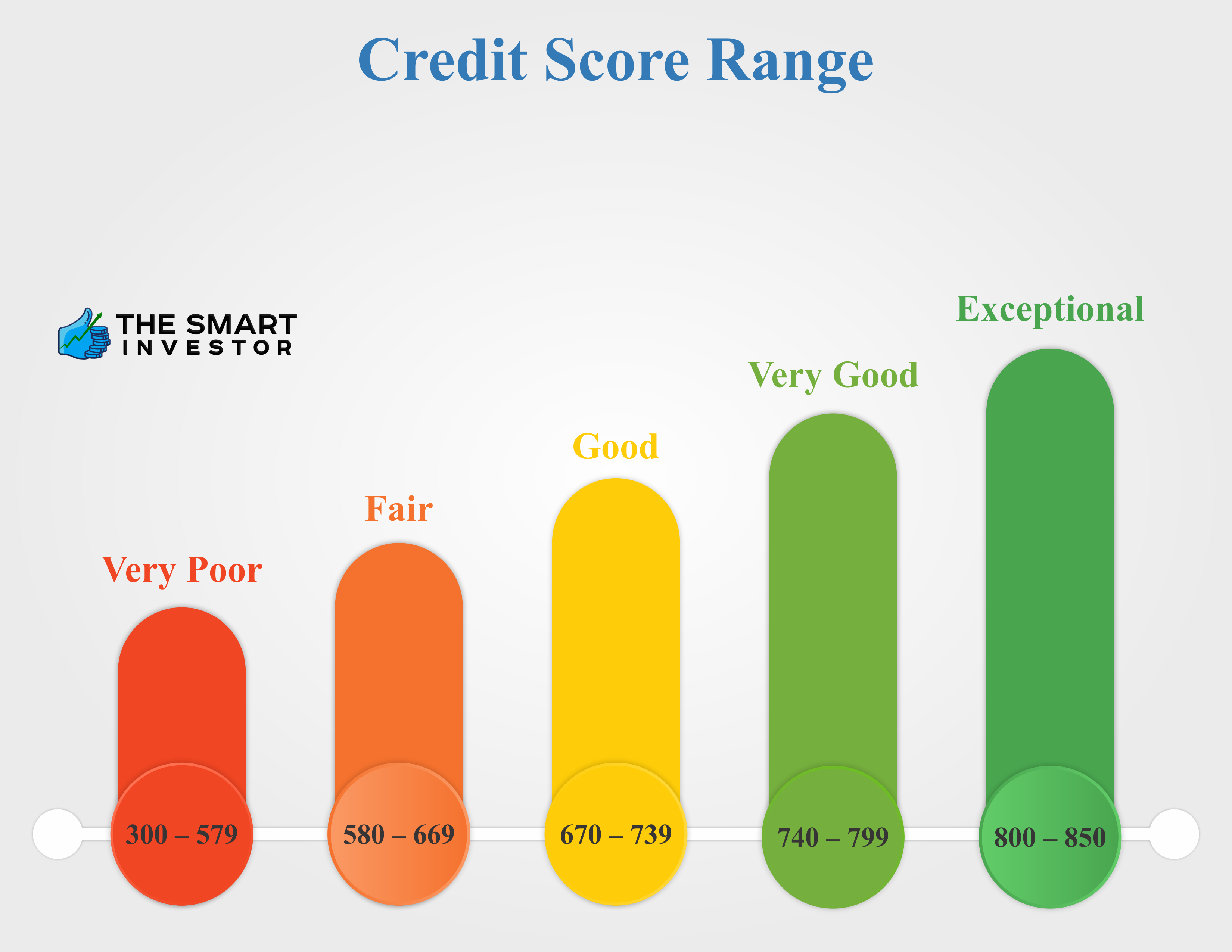

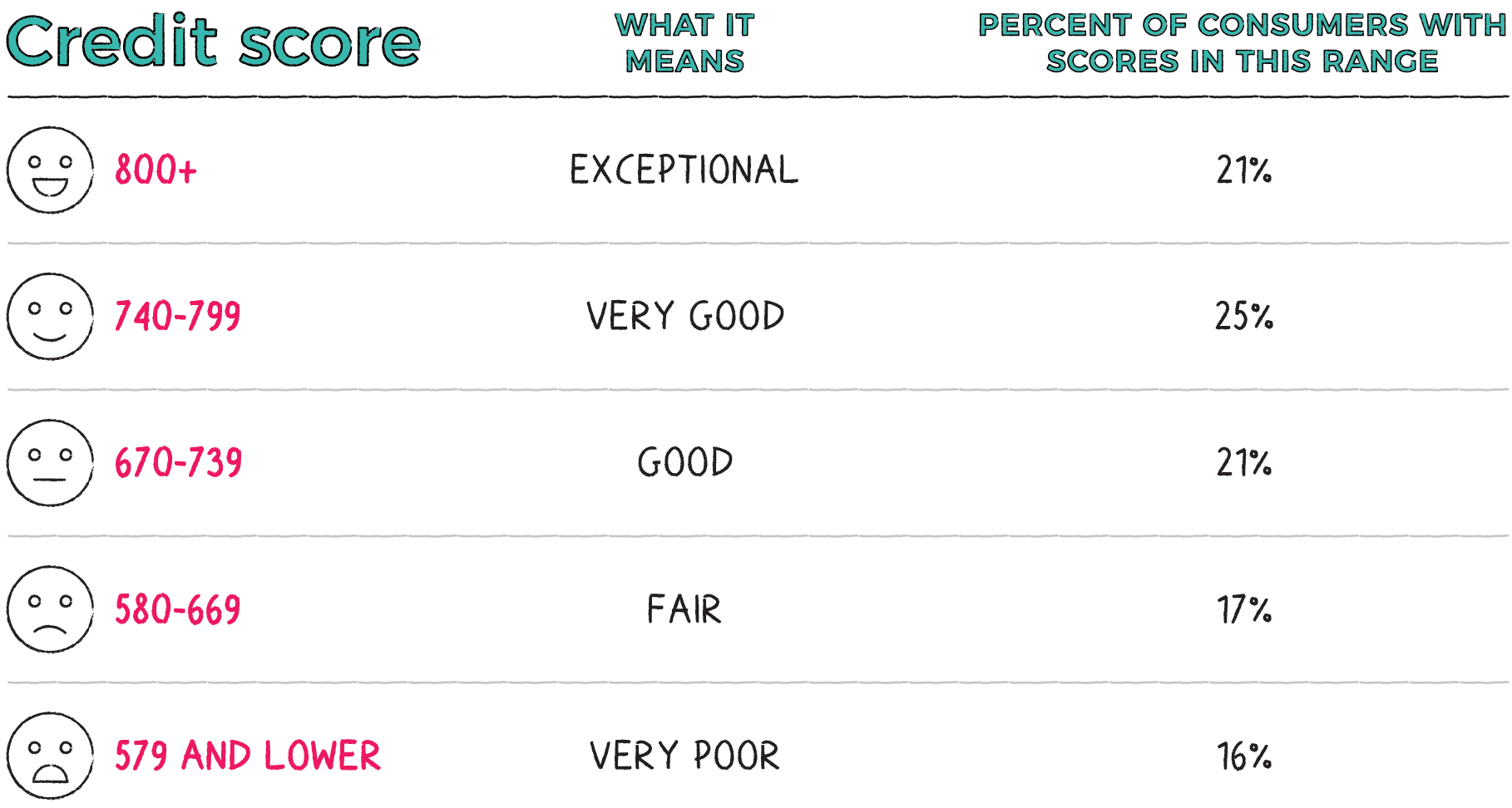

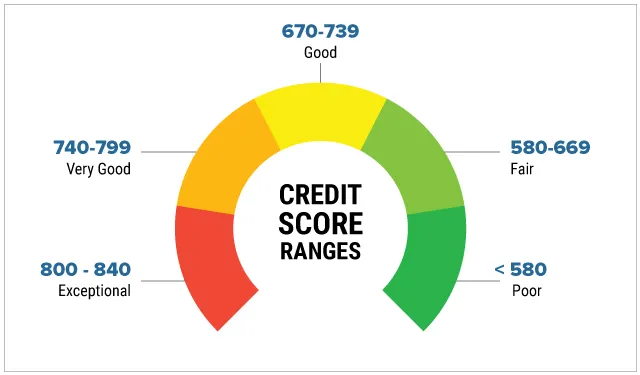

The interest rate will depend on your individual qualifications, the mortgage lender, and the date you lock your interest rate We can help connect you with a mortgage lender that offers free rate quotes To have a mortgage lender contact you, please fill out this formMay 22, 21 · The basic FICO scores run from 300 to 850 and classify creditworthiness as poor (below 580), fair (580 to 669), good (670 to 739), very good (740 to 799) and exceptional (800 up) The FICO model6/23/21 3180% 2440% 3670% 32% your credit score impacts your mortgage rate because it's a measure of how likely

Feb 28, 17 · 44% Individuals with a 670 FICO ® Score have credit portfolios that include auto loan and 27% have a mortgage loan Recent applications When you apply for a loan or credit card, you trigger a process known as a hard inquiry, in which the lender requests your credit score (and often your credit report as well)Apr 30, 21 · Your actual rate depends upon credit score, loan amount, loan term, and credit usage and history, and will be agreed upon between you and the lender For example, you could receive a loan of $6,000 with an interest rate of 799% and aGood Credit Score 670 to 739 Having a credit score between 670 and 739 places a borrower near or slightly above the average of US consumers, as the national average FICO score is

Car Loan Interest Rates With 670 Credit Score In 21

What Is A Credit Score Money

May 13, · According to FICO, with a score of 639, you'd get a 463% interest rate On a $216,000 mortgage with a 30year fixedrate loan, you'd pay $1,111 per month in principal and interest Now look at how much you save with a 760 credit score Your rate is now 304%, and your monthly payment is $915 That's a monthly savings of $196Jan 31, · Achieving a FICO score of 800 is the ultimate goal for many—and there's good reason for that People in the Excellent credit score range are the most likely to be approved for a credit card or loan, and they're also likely to get the best available terms and/or interest rates That's because lenders have a high degree of confidence people with scores in this range will670 to 739 are considered good;

Bad Credit Car Loan Calculator

790 Credit Score Is It Good Or Bad

740 to 799 are consideredStandard Definition Yes – A lot of people think good credit starts at a score of 660 and ends at a score of 719 WalletHub's Rating No – Based on the rate at which people with 670 credit scores get approved for credit cards that require "good credit" or better, we believe you actually need a credit score of to have good creditJun 25, 21 · Mortgage rates for credit score 670 on Lender411 for 30year fixedrate mortgages are at 299% That increased from 299% to 299% The 15year fixed rates are now at 256%

What Is A Fair Credit Score Credit Com

How To Build Credit As An Authorized User 21

FICO scores range from 300 to 850 As you can see below, a 670 credit score is considered Good Credit Score Rating % of population1 300 – 579 Poor 16% 580 – 669Jun 15, 21 · Credit scores (also known as FICO scores) of 650, 660, 670, 680, and 690 fall in the range of average to above average On the higher end of this range, a FICO score of 675 or above can be considered "good" In this credit score range, you start to see lower interest rates on credit cards A card may offer 1499% to 2499%Jun 25, 21 · About myfico myFICO is the consumer division of FICO Since its introduction over 25 years ago, FICO ® Scores have become a global standard for measuring credit risk in the banking, mortgage, credit card, auto and retail industries 90 of the top 100 largest US financial institutions use FICO Scores to make consumer credit decisions >> About myFICO

Avant Personal Loan Review 21

Recommended Score 6 to 7 Unlimited cash back on payments 3% on Home, Auto and Health categories and 1% on everything else $0 fees $0 annual fee, $0 activation fees, $0 maintenance fees Combine the flexibility of a card with the low cost and predictability of a loanJun 15, 21 · For example, DCU Credit Union – which lends nationally – is offering auto loans as low as 274% APR The minimum credit score they'll accept is 650, which is actually a little bit below the 670 to 739 range normally considered to be good creditMonthly Principal and Interest $0 Private Mortgage Insurance (PMI) $0 Property Taxes $0 Homeowner's Insurance $0 Your Total Monthly Payment $0 These figures are for estimation purposes only, as PMI, taxes, and homeowners insurance vary by county The exact amount you can afford will be affected by your credit history, current interest

2

What Is A Good Credit Score Credit Com

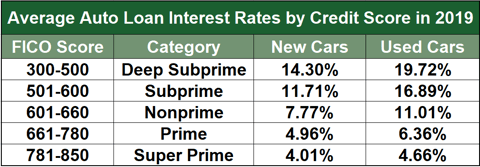

6 rows · FICO Credit Score APR * 670 676% Interest rate on car loan with 670 credit scoreFeb 24, · In general, a credit score above 670 will allow potential mortgage borrowers access to prime or favorable interest rates on their loan 2 Scores below 6 are considered to be subprime, and comeJul 16, 19 · An excellent credit score provides a lot of benefits — including greater negotiating power and better car insurance and mortgage interest rates But consumers with excellent credit also see the greatest perks when shopping for credit cards This is where you can qualify for toptier cards with the highest credit limits, greatest benefits, and richest rewards

Credit Score Hiep S Finance

What Credit Score Do You Need For A Car Loan News Cars Com

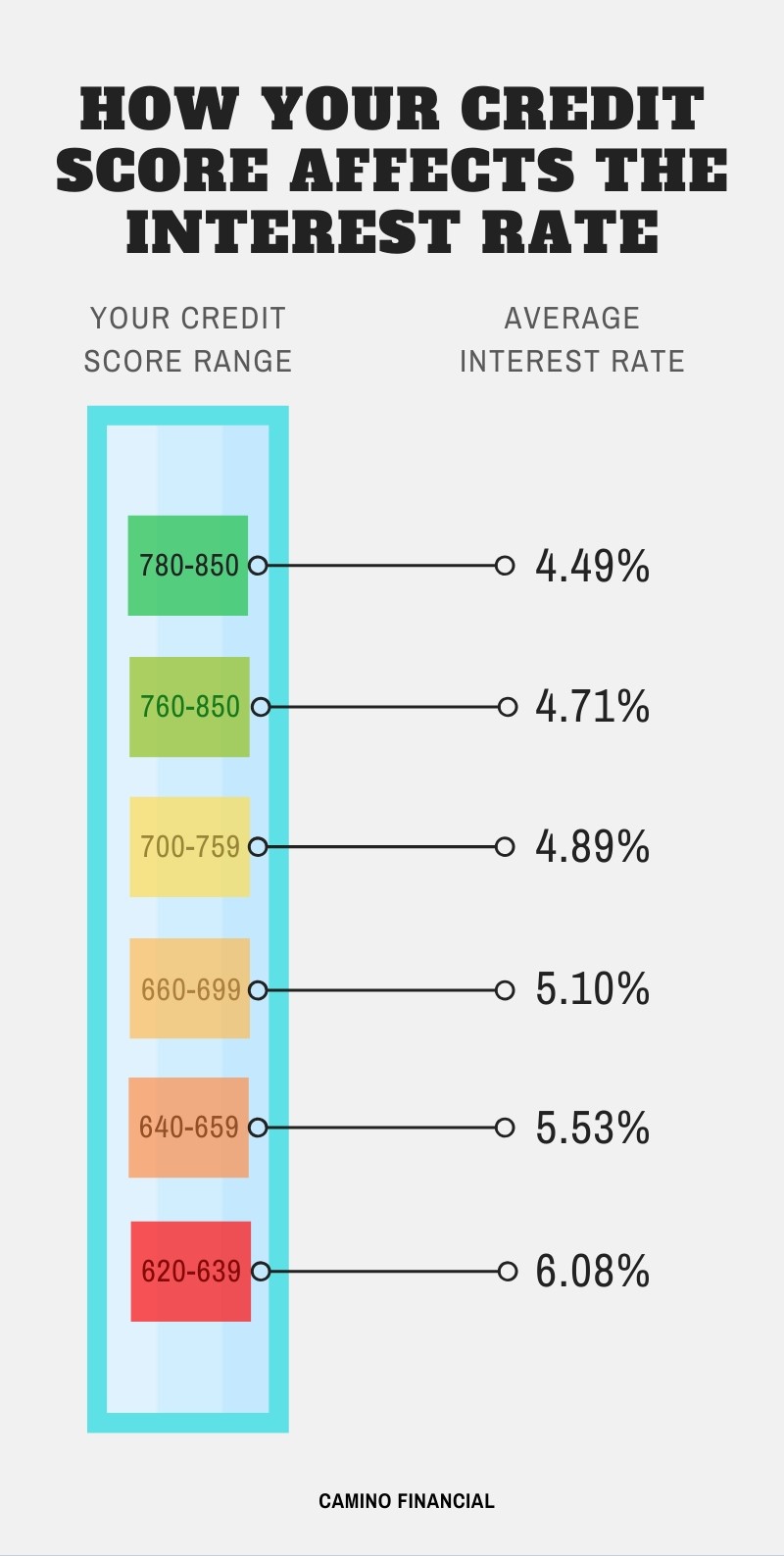

Feb 12, 19 · On the other hand, at a 702 percent interest rate, that same car will cost you $17,0 Now, if you were able to improve your credit score to Very Good (495 percent), that car would cost $16,964 That is a savings of right around $4,000 between Fair and Very Good Average Interest Rate Ranges Rates Divided by Credit Score RangeGood () People with a good credit score should have no problem getting approved for loans and lines of credit They'll get average interest rate offers on these kinds of deals They'll also have access to a higher credit limit on revolving credit linesJun 10, 21 · These credit scores range from 300 to 850, with a score over 670 being considered good and a score over 740 very good The interest rate you are charged on a loan is how banks make money and limit risk

Va Loans And Credit Score Minimums What All Buyers Need To Know

How To Boost Your Credit Score To Get A Good Mortgage Rate

May 21, 21 · With a 670 credit score, the FICO Loan Calculator now estimates that you might qualify for an APR around 7% Based on that rate, your monthly payment on the same $38,000 auto loan would be $768Sep 10, · Get a custom mortgage rate estimate here In this example, the borrower with a 680 credit score pays $63 more per month than someone with a 760 credit scoreApr 13, 21 · A FICO® credit score above 670 is generally considered "good" The same size loan with the same interest rate for 84 months would cost $9,277 in interest

How To Understand Your Credit Score Faqs

673 Credit Score Is It Good Or Bad

Unfortunately, a score of 670 is not a good credit score You will need a co signor to get any loan and almost impossible to get a credit card You may be able to obtain credit, but the rates will likely be much higher Disadvantages of low credit score When you apply for a loan or credit card the following may happenA good credit score to buy a home A good credit score typically falls into the range of using either the FICO score or the commonly employed VantageScore (created exclusively by Experian, TransUnion and Equifax) If you attain this score, you've demonstrated an ability to pay debts on time and maturely manage spendingOct 04, 10 · They came back with an offer of 13 14% interest depending on the term of the loan My credit score is 670 I had another dealer ran my SS# and he thought I should be able to get around 6% with that score Of course, he didn't do the full application

How To Raise Your Credit Score By 100 Points In 45 Days

The Average Heloc Interest Rate By Loan Type Credit Score And State

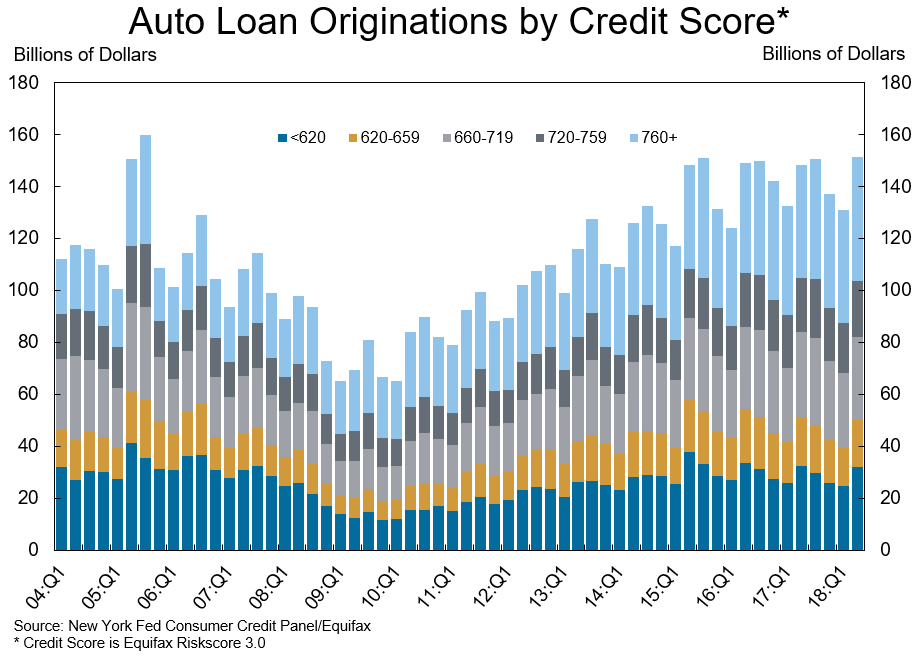

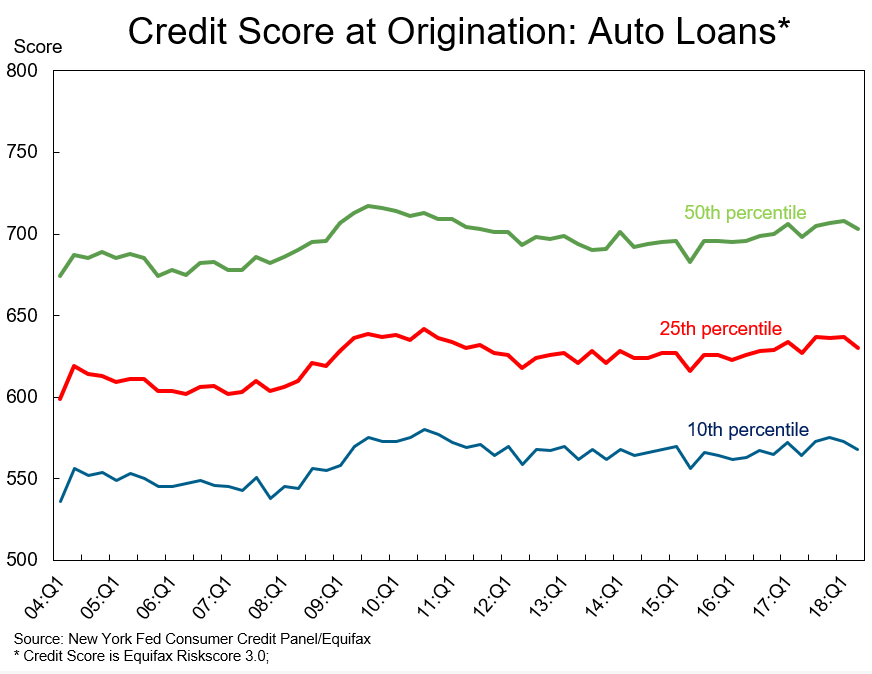

Sep 27, · The total interest paid on the mortgage would be $153,860 6 to 639 APR of 47% with a monthly payment of $1,048 The total interest paid on the mortgage would be $177,237 As you can tell, the interest rate, monthly payment, and total interest paid all increase as credit scores go downJun 01, 21 · Prime (661 to 780) 354% $671 Super Prime (781 to 850) 241% $656 With the interest rate as the only factor changed, a person with a credit score in the highest category will pay $656 a monthAug 16, · Experian's quarterly State of the Automotive Finance Market takes a look at the average auto loan interest rate paid by borrowers whose scores are in various credit score ranges As of the first quarter of , borrowers with the highest credit scores were, on average, nabbing interest rates on new cars below 4%

How To Turn A 650 Credit Score Into Good Credit

Credit Repair And Credit Score In Erie Pa Tips Tools Credit Repair Credit Score Credit Score Chart

May 28, 21 · The difference in VA mortgage interest rates between a credit score of 600 or 604 and 670 or 676 can be as much as a whole percentage point Over the course of a 30year loan, an interest rate a whole percentage point lower can literally save you fifty to a hundred thousand dollars over the life of the loanFeb 14, 18 · The FICO credit score range spans from 300 to 850, with 850 being the best possible credit score Under this model, a credit score above 740 is considered to be an "excellent" score, which, under our lockandkey analogy, effectively gives those with a FICO credit score of 740 or better a master key to nearly every credit card lock on the marketMar 29, 21 · Mar 29, 21 There is no specific minimum credit score required to buy a car But the higher your credit score is, the more options you'll have and the more you'll save on auto loan interest For example, newcar buyers had an average credit score of 714 as of the first quarter of 17, according to the latest data from Experian

/how-your-credit-score-influences-your-interest-rate-960278_fin2-6e9a6586481946a4a418afa6d7e2522e.png)

How A Credit Score Influences Your Interest Rate

11 Best Low Interest Personal Loans Rates Starting At 1 99 Apr Finder

Aug 06, · The higher your credit score, the lower the interest rate on your mortgage The higher your credit score, the lower the interest rate on your mortgage Good;Nov , 18 · Lenders' minimum credit score requirements range from 650 to 680 The better your credit, the lower the rate you'll likely get The credit scores of10 rows · *Sample Quote For Credit Scores of 670 to 679 Single digit credit score changes don't

How Your Credit Score Affects Your Mortgage Rate Bankrate

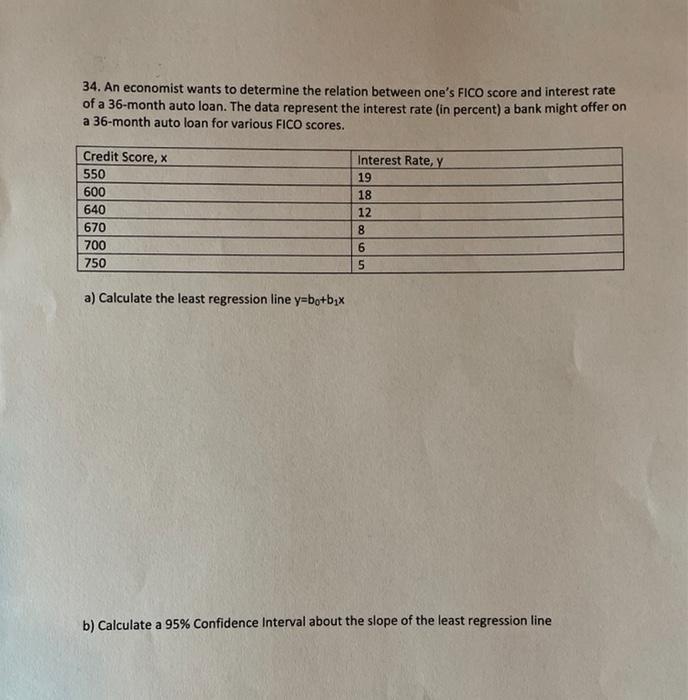

Solved 9 An Economist Wants To Determine The Relation Be Chegg Com

What are the interest rates for a borrower with a 670 credit score?Oct 17, 17 · Allen's middle FICO score of 665 is considered fair on the scale for credit score tiers below According to FHA guidelines, the credit score needed to buy a house is 580 From a credit score perspective, Allen is in good shape If he meets the other FHA requirements, we could expect approval for a FHA loan He would get a good interest rate

Wonder What A Credit Score Is We Explain Comparecards

600 Credit Score Car Loans 21 Badcredit Org

Best Auto Loan Rates With A Credit Score Of 670 To 679 Credit Knocks

Best Personal Loans For Fair Credit Credit Score 600 669

Today S Mortgage Interest Rates Jan 7 21 Forbes Advisor

4 Ways To Improve Your Credit Score Wikihow

How Credit Scores Affect Your Interest Rate

Can I Get An Installment Loan With Bad Credit Advance America

Search Q 700 Credit Score Tbm Isch

What Are The Different Credit Score Ranges Experian

What Is A Good Credit Score Forbes Advisor

Size Up Your Credit Score Smart About Money

Www Dhimortgage Com Getattachment 1db95c 92fb 4277 9c 12c0bda01ee1 What Is Good Credit

How To Raise Your Bad Credit Score Above 700 Mybanktracker

Military Credit Repair Omni Financial

Virtual Programming Budgeting Credit Scores Youtube

Best Fha Loan Rates With 640 670 Credit Score

Bad Credit Car Loan Calculator

Bad Good Excellent Credit Score Ranges

Is A 700 Credit Score Good Or Bad Student Loan Hero

Average Credit Score In America 21 Report Valuepenguin

Q Tbn And9gcskcxt0uanxg Stgrhwygvutjj67ejxgikkqyovyi9s54q Cmyn Usqp Cau

Best Auto Loan Rates With A Credit Score Of 670 To 679 Credit Knocks

What Is A Bad Credit Score Lexington Law

How To Understand Your Credit Score Faqs

Credit Card Consolidation Options Credit Repair

670 Credit Score Is It Good Or Bad What Does It Mean In 21

Best Auto Loan Rates With A Credit Score Of 670 To 679 Credit Knocks

What Is Good Credit And Why Does It Matter Ally

670 Credit Score Is It Good Or Bad What Does It Mean In 21

What Is A Fico Score Camino Financial

670 Credit Score Good Or Bad Auto Loan Credit Card Options Guide

What Is A 680 Credit Score Credit Sesame

Fico Score America First Credit Union

/dotdash_final_800_Plus_Credit_Score_How_to_Make_the_Most_of_It_Dec_2020-01-eab02cc511db4ce19ab3c1869e750d3b.jpg)

800 Plus Credit Score How To Make The Most Of It

/GettyImages-1041512942-60ac71d4ef574abbada73644f78ca0cb.jpg)

Is My Credit Score Good Enough For A Mortgage

What Is Considered A Bad Credit Score Sofi

What Is A Good Credit Score Lexington Law

Everything You Need To Know About Credit Scores Makingcents Navy Federal Credit Union

What Is Credit Master Your Card

10 Personal Finance Tips To Improve Your Credit Score

All You Need To Know About Credit Score Interest Rates

What Is A Good Credit Score Understanding Credit Score Best Egg

Credit Score Below 670 Find Out What It Means Creditscorepro Net

Best Personal Loans For Good Credit Credit Score 670 739

What Kind Of Mortgage Interest Rate Can I Get With A 750 Credit Score Experian

Is 700 Really A Good Credit Score Credit Sesame

Average Credit Score In America 21 Report Valuepenguin

How To Qualify For A Powersport Loan Lendingtree

Dnhg0fkecrholm

Credit Score Ranges Basics How Does It Work The Smart Investor

6 Credit Score Is 6 A Good Credit Score Or Bad Bestloansproviders

Best Auto Loan Rates With A Credit Score Of 670 To 679 Credit Knocks

Best Auto Loan Rates With A Credit Score Of 670 To 679 Credit Knocks

4 Easy Steps To Get A Car Loan At Best Interest Rates Read This Infographic To Know The 4 Easy Steps To Get Aca Car Loan Calculator Car Loans Loan Calculator

How To Build Credit From Scratch Napkin Finance Has The Answer

Credit Scores How To Understand Yours Credit Karma

Pin On Money Stuff

600 Credit Score Car Loans 21 Badcredit Org

Solved 34 An Economist Wants To Determine The Relation B Chegg Com

Credit Score Ranges What Really Is A Good Credit Score Guaranteed Rate

650 Credit Score Good Or Bad Auto Loan Credit Card Options Guide

Credit Career Center Usc

Tax Liens Will No Longer Be Included In Credit Scores Or On Credit Reports

Buying A Home Check Your Credit Report And Score

700 Credit Score Do This Wealthfit

Credit Cards Loans For Credit Score 600 650 Mybanktracker

Best Auto Loan Rates With A Credit Score Of 670 To 679 Credit Knocks

What Is A Good Credit Score Nerdwallet

What Is A Bad Credit Score

What Is A Good Credit Score Nerdwallet

660 Credit Score Is It Good Or Bad

Mortgage Rates Just Spiked Is It A Good Time To Refinance Money

How To Raise Your Credit Score Fast Mortgage Rates Mortgage News And Strategy The Mortgage Reports

What Is A Credit Score Money

9 Things To Do Now If You Have An 800 Credit Score

3

1

Best Fha Loan Rates With 640 670 Credit Score

Auto Buyers Credit Repair Fix My Credit Credit Expert Llc

コメント

コメントを投稿